can you pay california state taxes in installments

It may take up to 60 days to process your request. Usually you can have from three to five years to pay off your taxes with a state installment agreement.

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Get Your Tax Options for Free.

. Ad Complete Tax Forms Online or Print Official Tax Documents. File With Confidence Today. Defend End Tax Problems.

You can pay the amount in 60 months or less. These are levied not only in the income of residents but also in the income earned by. Franchise Tax Board State of California Installment Agreement Request We will always ask you to immediately pay your tax liability including interest and penalties in full.

In California you pay half the tax in advance and the other half in arrears of the start of the fiscal year. Complete Edit or Print Tax Forms Instantly. Defend End Tax Problems.

Instalments are due and payable until the 15th day of the 4th 6th 9th and 12th month of the taxation year. Can you pay Ga state taxes in installments. If the due date falls on a weekend or holiday the deadline for submission and.

With full payment plans theres a short-term payment plan. If you owe a tax debt to the Georgia Department of Revenue and cannot afford to pay it all at once you can. The filing deadline is not too far away and unless you want to miss the deadline you should make up for lost time with your return and pay as much as you need up until the.

Get Your Tax Options for Free. Trusted Tax Resolution Professionals to Handle Your Case. Youve filed all your income tax returns for the past 5.

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. I have installments set up for my federal taxes but I did not see an option for California state taxes. Ad We End IRS State Tax Issues.

Ad We End IRS State Tax Issues. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. The personal income tax rates in California range from 1 to a high of 123 percent.

Answer Simple Questions About Your Life And We Do The Rest. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. If a Full Payment Agreement is not financially attainable you may be eligible for a Long-Term Payment Plan which entails an Installment.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Amount due is less than 25000. Answer Simple Questions About Your Life And We Do The Rest.

A Rated in BBB. It may take up to 60 days to process your request. If you cannot afford to pay your California tax liability you can apply for a monthly payment plan.

If you are unable to pay your state taxes you can apply for an installment agreement. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. Can I Pay My Taxes On Installments.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Arrears however is a deceptive term because it literally means money owed as a past. A Rated in BBB.

File With Confidence Today. Can I Pay My Taxes in Installments. You must owe less than 25000 in state income tax and meet other.

Trusted Tax Resolution Professionals to Handle Your Case. Depending on your tax situation you will be able to make payments in a number of ways. You may be eligible for an installment agreement if.

If youre in the unfortunate position that you owe taxes the IRS offers several payment options you can use to pay immediately or arrange to pay in installments. Per Revenue and Taxation Code State of California.

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

Can I Pay Taxes In Installments

Commercial Property Lease Agreement How To Create A Commercial Property Lease Agreement Download This C Lease Agreement Lease Agreement Free Printable Lease

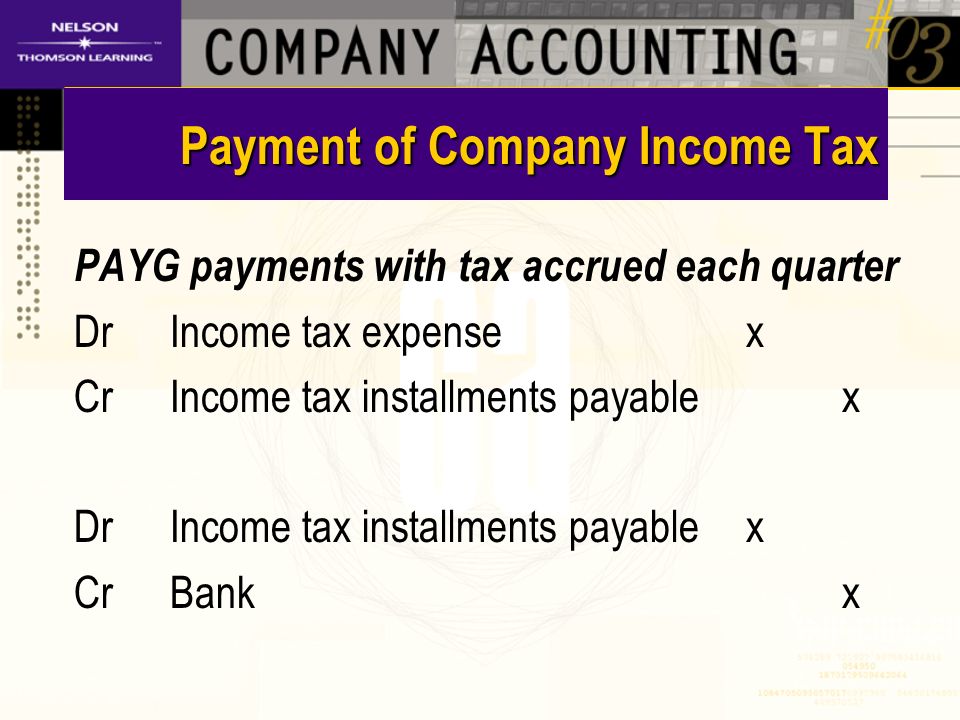

Chapter 12 Income Tax Ppt Download

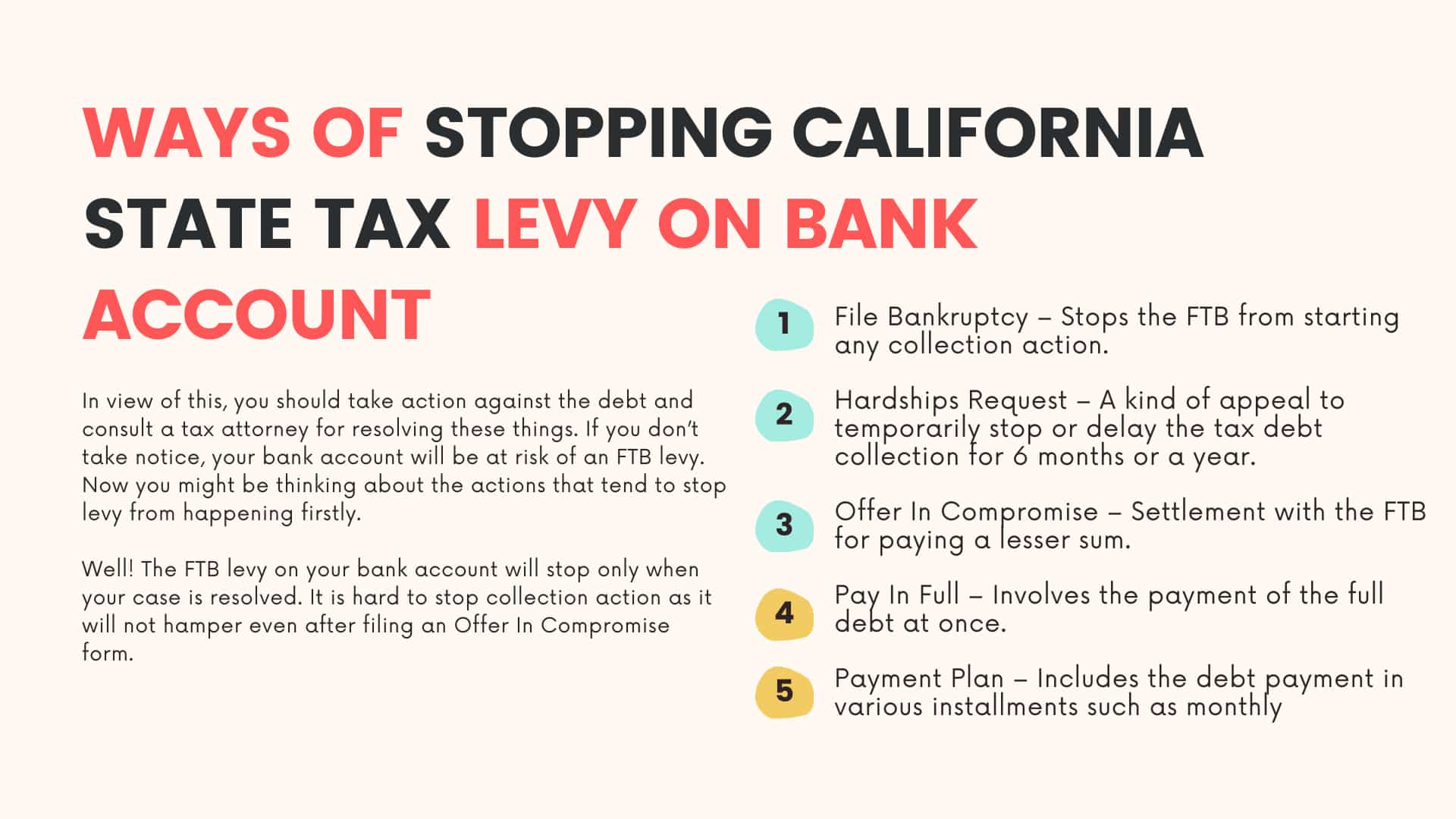

3 Proven Ways To Stop California State Tax Levy On Bank Account

California Tax Payment Plan Get California Tax Help Today

Sample Commercial Rental Agreement Rental Agreement Templates Room Rental Agreement Commercial

Supplemental Secured Property Tax Bill Placer County Ca

Secured Property Taxes Treasurer Tax Collector

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Property Tax Prorations Case Escrow

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Lease And Buy Agreement Real Estate Forms Real Estate Real Estate Contract

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

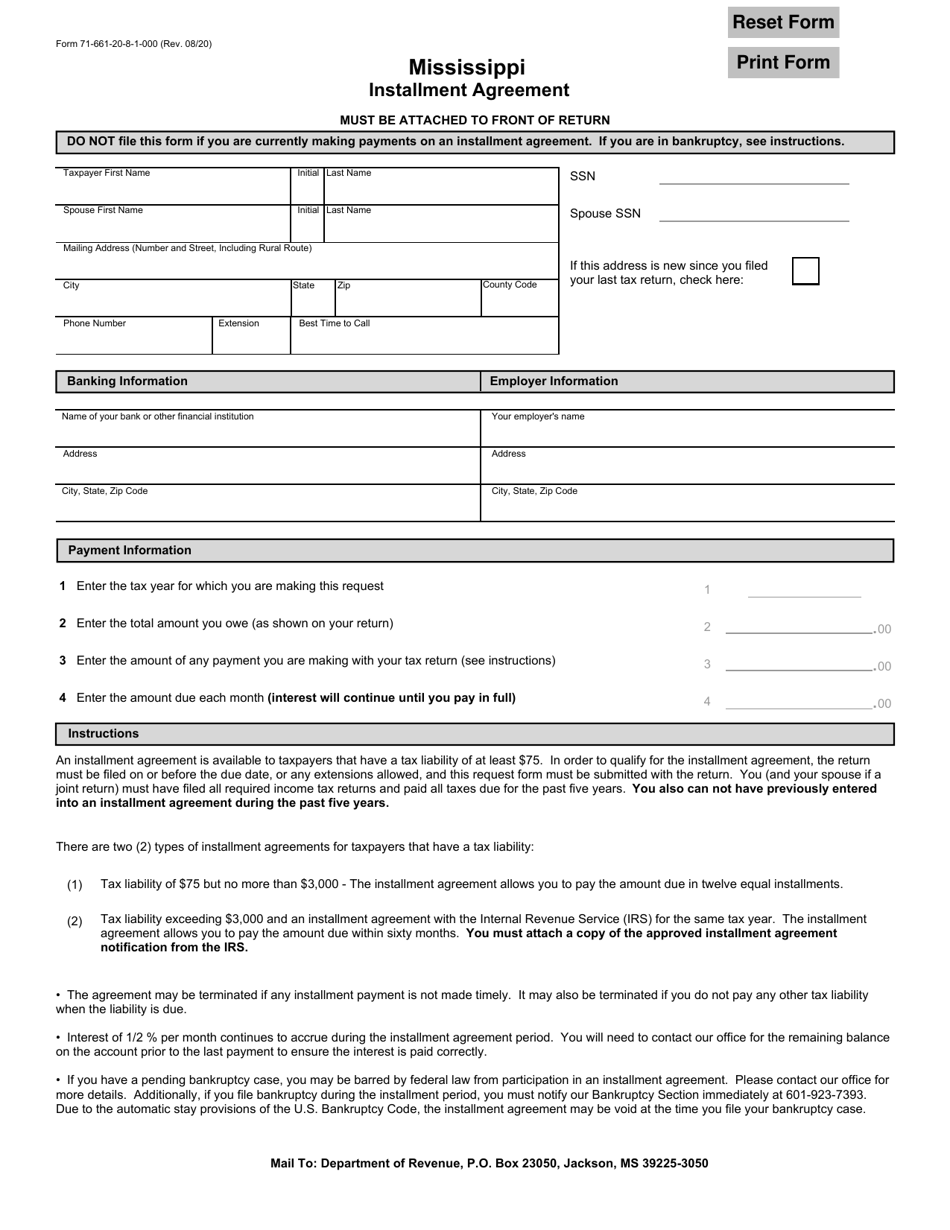

Form 71 661 Download Fillable Pdf Or Fill Online Mississippi Installment Agreement Mississippi Templateroller

Irs Letter 4458c Second Installment Agreement Skip H R Block

M M Tax Relief Mmfinancial Twitter

Second Installment Payments For 2019 20 Secured Property Tax Bills Are Due February 1st County Of San Luis Obispo